What is the scam?

This scam begins when you receive what appears to be a fraud alert from your bank, usually by text message. If you respond, a scammer will call you from a number that looks like your bank’s official fraud department. They claim there is suspicious activity on your account and offer to help you secure it. The supposed solution involves sending money to yourself through Zelle to verify your identity or reverse a fraudulent transaction. In reality, the scammer has manipulated the system so that any money you send goes directly to them, not back to your own account.

How this scam usually works

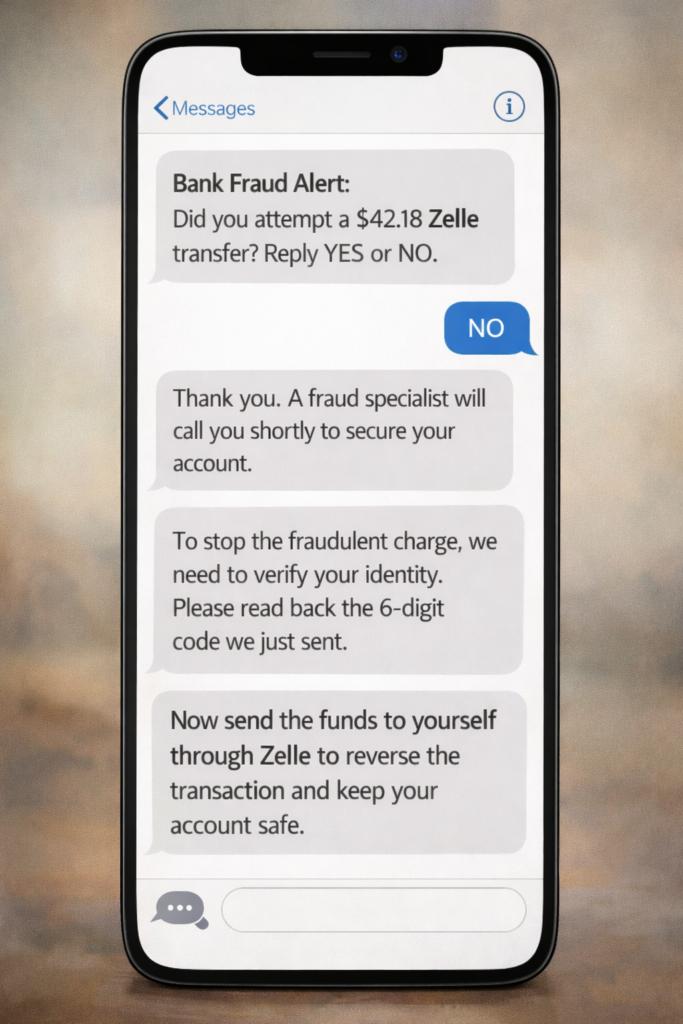

The scam typically starts with an unsolicited text message warning you about a suspicious transaction or attempted login on your account. If you reply or call the number provided, you will be connected with someone claiming to work in your bank’s fraud department. The caller ID may even show your bank’s name because scammers can spoof phone numbers to appear legitimate.

During the call, the scammer will ask you to verify your identity by reading back a one-time security code sent to your phone. This is the critical moment of the scam. That code is actually the verification code Zelle uses when enrolling a new account. By giving it to the scammer, you allow them to register their own bank account with Zelle using your phone number or email address.

Once their account is linked to your contact information, the scammer instructs you to send money to yourself as a way to prove your account is secure. Because your phone number or email is now connected to the scammer’s bank account, the payment goes to them instead. Since you technically authorized the transaction, it can be very difficult to recover the funds.

How to protect yourself

Your bank will never ask you to send money to yourself. This is the single most important thing to remember. If anyone claiming to represent your bank asks you to make a Zelle transfer for any reason, including to yourself, end the conversation immediately.

Never share one-time security codes with anyone. These codes exist to verify your identity, and no legitimate bank employee will ever ask for them over the phone. If someone asks for a code that was just sent to your phone, you are almost certainly speaking with a scammer.

If you receive a fraud alert and are unsure whether it is real, hang up and call your bank directly using the number on the back of your debit card or on your bank’s official website. Do not call any number provided in a text message or by someone who contacted you first.

What to do if you’ve been affected

If you have already sent money in this type of scam, contact your bank’s fraud department immediately. Explain that you were tricked into making the transfer by someone impersonating a bank representative. While Zelle transfers are typically instant and difficult to reverse, some banks have begun offering reimbursement for certain impersonation scams, particularly after regulatory pressure in 2023 and 2025.

File a complaint with the Federal Trade Commission at ReportFraud.ftc.gov. If your bank is unresponsive or refuses to investigate, you can also submit a complaint to the Consumer Financial Protection Bureau. These reports help regulators track scam patterns and hold financial institutions accountable.

Change the passwords and security questions for your online banking account, even if the scammer did not directly access it. Enable two-factor authentication if you have not already. Watch your account statements closely for any additional unauthorized activity over the following weeks.