What is the scam?

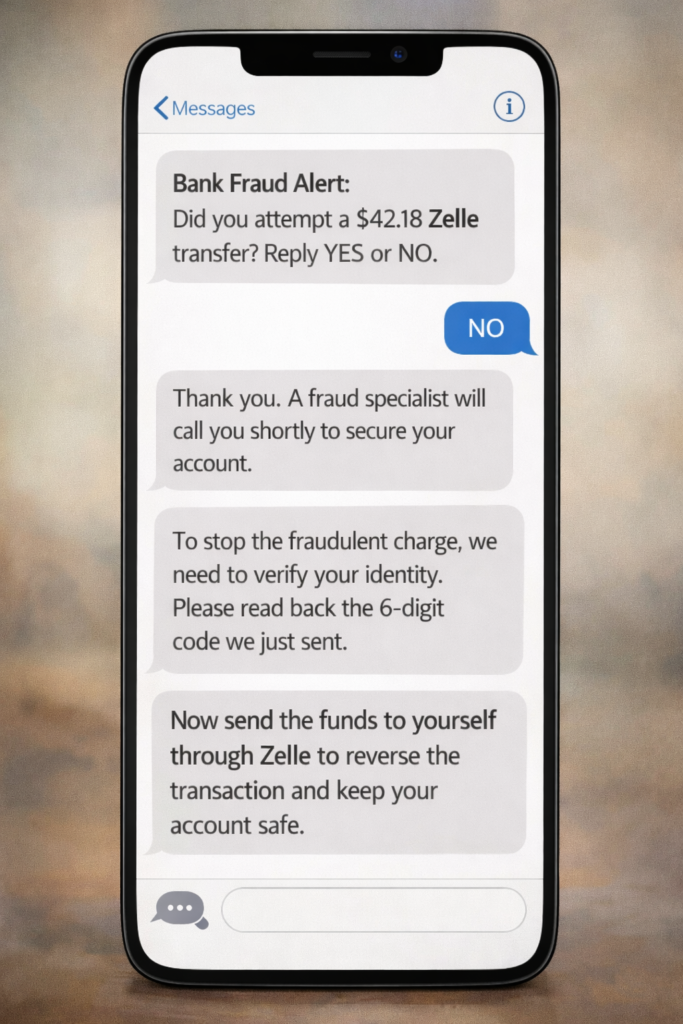

The Zelle impersonation scam involves fraudsters calling or texting victims while pretending to be their bank’s fraud department, security team, or Zelle itself. The scammer claims there’s been suspicious activity on the victim’s account or unauthorized Zelle transactions and says immediate action is needed to protect the money.

The goal is to manipulate the victim into using Zelle to send money to the scammer, often by telling the victim they need to transfer funds to a “safe account,” reverse a fraudulent transaction, or verify their identity by sending money to themselves. Real banks and Zelle will never call asking you to send money through Zelle to stop fraud, but scammers exploit the trusted relationship people have with their financial institutions to create panic and bypass normal skepticism.

How this scam usually works

The scam typically begins with an unexpected phone call, text message, or even a legitimate-looking alert that appears to come from your bank or Zelle, warning about suspicious account activity or unauthorized transactions. The scammer may spoof the bank’s real phone number on caller ID to make the call appear authentic, and they often have some basic information about you like your name, partial account number, or recent transaction details obtained through data breaches or social engineering.

Once they have you on the line, they create urgency by claiming your account is under attack or money is about to be stolen, then guide you through “fixing” the problem by opening your Zelle app and sending money to a phone number or email address they provide, framing it as transferring funds to your own safe account, canceling a fraudulent payment, or verifying your identity.

After the initial transfer, scammers frequently follow up with additional requests, claiming the first transfer didn’t work, more fraud was detected, or you need to send additional verification payments, continuing until the victim becomes suspicious or runs out of available funds. Some sophisticated operations even have multiple people playing different roles, such as a “supervisor” who gets on the line to add credibility or a “verification department” that confirms the fraud story.

How to protect yourself

Always remember that your bank, credit union, and Zelle will never call, text, or email asking you to send money through Zelle to protect your account, stop fraud, or verify your identity, and any such request is a scam regardless of how legitimate it appears. If you receive an alert about suspicious activity or fraud, hang up immediately and contact your financial institution directly using the phone number on the back of your debit card, your bank statement, or the official website you navigate to yourself rather than clicking any links in messages or calling numbers provided by the caller.

Never send money to yourself through Zelle at someone else’s instruction, since Zelle transactions are instant and generally irreversible, meaning once you authorize a payment it’s extremely difficult to recover those funds even when you’ve been tricked. Enable two-factor authentication on your bank accounts and Zelle profile, use strong unique passwords, and be immediately suspicious of any call that creates artificial urgency or pressure to act quickly, as this is the primary tactic scammers use to override your better judgment.

Consider setting up account alerts through your bank’s official app so you can monitor transactions in real time without relying on unsolicited messages that may be fraudulent, and educate family members, especially older adults who are frequently targeted, about how these impersonation scams work.

What to do if you’ve been affected

If you’ve sent money through Zelle because of an impersonation scam, you’re not alone and this happens to thousands of people despite being careful and intelligent consumers. Immediately contact your bank or credit union’s fraud department using the official phone number on your card or statement to report the scam, explain exactly what happened, and ask if they can attempt to recall or reverse the transaction, though be aware that Zelle’s instant transfer system makes recovery difficult and banks often cannot retrieve funds sent to scammers.

Report the scam to Zelle directly through their website at zellepay.com and file a report with the Federal Trade Commission at ReportFraud.ftc.gov and your local police department to create an official record that may help with any disputes or recovery efforts. Change your banking passwords, PINs, and security questions, enable additional account security features, and monitor your accounts closely for any unauthorized activity since scammers who have engaged with you once may try again or may have obtained additional personal information during your interactions.

Be extremely cautious of anyone who contacts you claiming they can recover your lost funds for an upfront fee, as recovery scams are common follow-ups that target people who have already been victimized, and legitimate recovery services do not require payment before recovering money. Document everything including phone numbers that called you, exact times of contact, names the scammers used, and amounts sent, as this information may be valuable if any recovery options become available or if you pursue a formal complaint with your financial institution or regulatory agencies.

Related Articles

Zelle Scam – Start Here

Zelle Payment Reversal Scam

Zelle Refund Scam