Why scammers ask for gift cards, crypto, and Zelle

One of the clearest warning signs of a scam isn’t what someone says — it’s how they want you to pay. Again and again, scams end the same way: a demand for gift cards, cryptocurrency, wire transfers, or instant payment apps like Zelle. This isn’t a coincidence. These payment methods are attractive to scammers for very specific reasons, and understanding those reasons makes it much easier to spot trouble before money is lost.

The common thread behind these payment methods

Gift cards, crypto, and instant transfers all share one critical trait: they’re difficult or impossible to reverse. Once the money moves, it’s usually gone for good. Scammers don’t want payments that can be disputed, delayed, or traced. They want speed, finality, and distance from accountability — and these methods provide exactly that. Reports from the Federal Trade Commission consistently show that scams involving gift cards, cryptocurrency, and peer-to-peer payment apps account for a significant share of consumer fraud losses each year, far more than traditional payment methods.

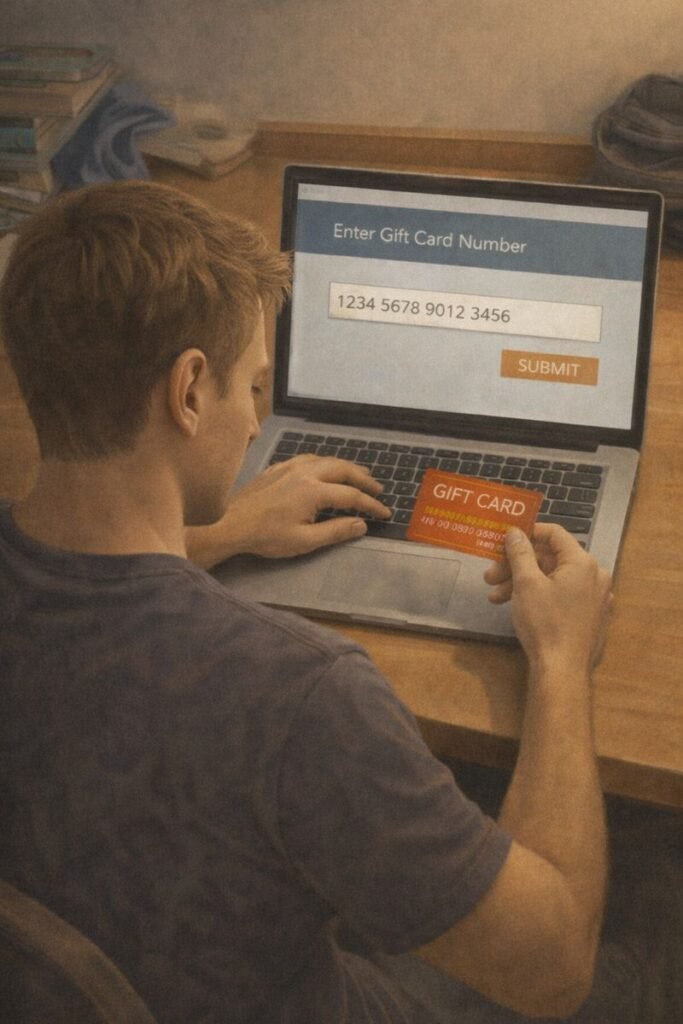

Why gift cards are a favorite tool

Gift cards are especially popular because they’re widely available and easy to liquidate. Once the code is shared, the funds can be drained almost instantly, often before the victim even realizes what’s happening. There’s no name attached, no billing address, and no realistic way to claw the money back. Scammers often frame gift cards as a workaround — claiming that a system is down, a payment failed, or an urgent situation requires immediate action. The unusual nature of the request is intentional. It creates confusion, and confusion creates compliance.

Why cryptocurrency appeals to scammers

Cryptocurrency adds another layer of protection for scammers: anonymity and global reach. Crypto transactions are permanent and typically irreversible. Once sent, there’s no customer service department to call and no fraud team that can freeze the transfer. Scammers often use crypto to sound modern or authoritative, especially in investment scams or tech-related fraud. They may claim it’s safer, faster, or more advanced than traditional banking. In reality, it removes many of the safeguards that exist to protect consumers.

Why instant payment apps are often used in scams

Apps like Zelle, Cash App, and similar services were designed for fast, trusted transfers between people who know each other. When scammers use them, they exploit that trust. Payments move immediately, and banks often treat them as authorized transactions — even when deception is involved. Scammers may impersonate banks, utilities, employers, or even family members to justify the urgency. The goal is to push you to act before you have time to question whether the request makes sense.

The role of urgency and pressure

These payment methods only work if you don’t stop to think. That’s why scammers nearly always add pressure: deadlines, threats, warnings, or emotional appeals. They want you focused on resolving a problem, not evaluating whether the payment itself is reasonable. When someone insists you must act right now and insists on one of these methods, it’s not efficiency — it’s a trap.

How to protect yourself

A simple rule goes a long way: treat any demand for gift cards, cryptocurrency, or instant transfers as a red flag, especially when the request is unexpected. Real organizations don’t need secrecy, speed, or unconventional payment methods to operate. If you’re unsure, pause. Contact the organization through a known, official channel. Talk it through with someone you trust. Scammers rely on isolation and urgency — breaking either one often breaks the scam.

If you’ve already paid

If you’ve already sent money using one of these methods, you’re not alone. Many smart, careful people have been caught the same way. Act quickly by contacting your bank or payment provider, even if recovery is unlikely. Reporting the scam can still help prevent future harm and protect others. Understanding why scammers prefer these payment methods turns a vague warning into a concrete defense. Once you know what to look for, these requests stand out — and that pause can make all the difference. If this type of payment request showed up in a message you received, you may want to browse our Common Scams and Emerging Scams sections to see how similar situations typically unfold.