What is the overpayment scam?

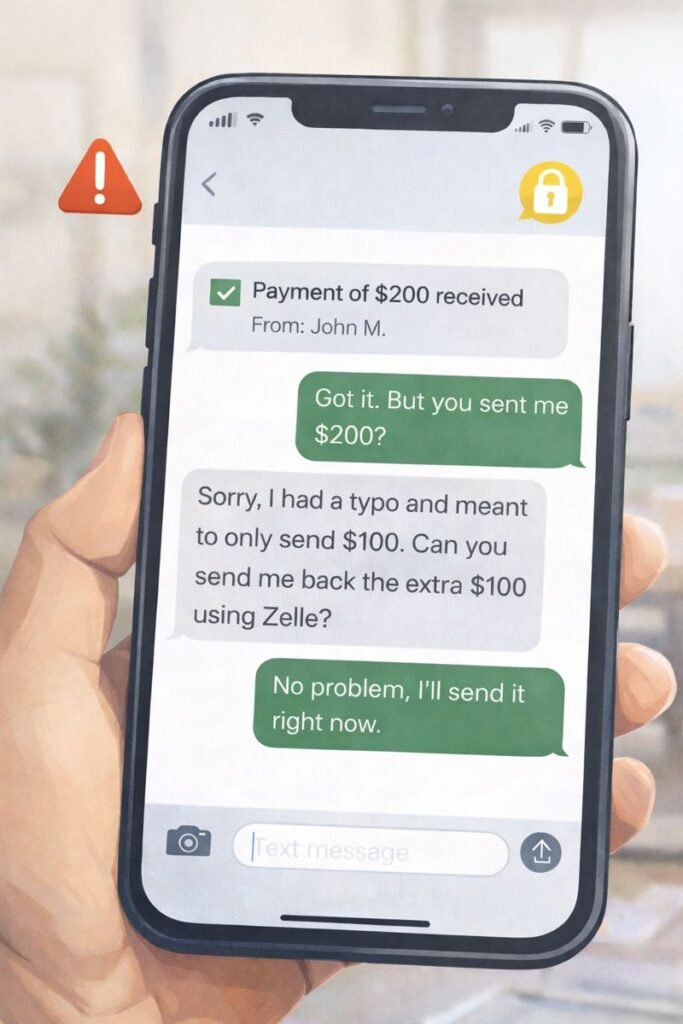

The overpayment scam happens when someone sends you more money than you were expecting and asks you to return the extra amount. The initial payment often looks legitimate at first, but later turns out to be fake, reversed, or stolen. By the time the payment fails, the money you sent back is already gone, leaving you responsible for the loss.

How this scam usually works

Scammers commonly use this tactic when buying items online, hiring for fake jobs, or sending payments by check, ACH, or peer-to-peer apps. They may claim the overpayment was an accident, blame a payroll error, or say a third party sent the wrong amount. They will often pressure you to refund the difference quickly, before the original payment has fully cleared.

How to protect yourself

Never send money back until you are completely certain the original payment has fully cleared and cannot be reversed. Be cautious of anyone who creates urgency, uses unusual payment methods, or gives complicated explanations for why too much money was sent. When possible, use platforms that handle refunds internally instead of sending money directly.

What to do if you’ve been affected

If you’ve already sent money back and later discover the payment was fraudulent, contact your bank or payment provider immediately to see if recovery is possible. Save all messages, transaction records, and payment details, and report the incident at ReportFraud.ftc.gov. Even if the money cannot be recovered, reporting helps protect others.