What is the free trial cancellation scam?

The free trial cancellation scam refers to a common billing tactic where a “free” or low-cost trial quietly turns into a paid subscription that is difficult to cancel. People are often charged without clear reminders, face confusing cancellation steps, or continue to be billed even after trying to cancel. While some companies operate in legal gray areas rather than committing outright fraud, the result for consumers is the same: unexpected charges that are hard to stop or recover. This scam is especially common with apps, online services, fitness programs, streaming platforms, and digital tools that advertise “cancel anytime” or “no risk” trials.

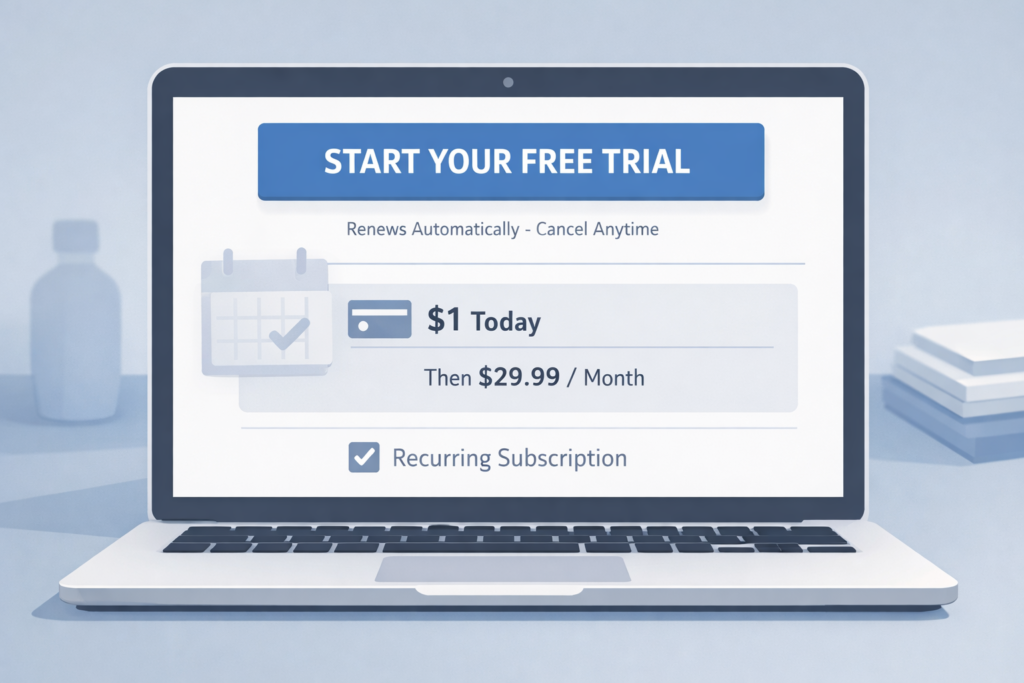

How this scam usually works

Someone signs up for a free trial or a heavily discounted introductory offer using their credit card or payment app. The trial period ends quietly, often without a clear reminder, and the subscription automatically renews at full price. When the person notices the charge and tries to cancel, they may encounter hidden cancellation links, multi-step confirmation screens, required phone calls, or delayed responses from customer support. In some cases, the company claims the subscription was never canceled or continues billing for additional cycles before stopping the charges. By the time the issue is resolved, the person may have lost weeks or months of payments.

How to protect yourself

Be cautious with free trials that require a payment method upfront, especially if the cancellation terms are vague or buried in fine print. Take screenshots of confirmation pages, cancellation steps, and emails when you sign up and when you cancel. Set calendar reminders a few days before any trial ends so you can cancel in time if you don’t want to continue. Regularly review your bank and credit card statements for unfamiliar or recurring charges, even small ones. Using virtual card numbers or subscription-tracking tools can also make it easier to stop unwanted billing.

What to do if you’ve been affected

If you notice an unexpected charge, contact the company immediately and request cancellation and a refund. Keep records of all communication, including emails, chat transcripts, and timestamps. If the company is unresponsive or refuses to help, contact your bank or credit card issuer and ask about disputing the charge. You can also report the situation to the FTC at ReportFraud.ftc.gov to help document recurring billing abuse patterns. Even if you don’t recover the money, reporting helps regulators track companies that rely on deceptive billing practices.

Related articles

Subscription Renewal & Billing Scam: How It Works and How to Avoid It

Fake Invoice Scams: How Criminals Pressure People Into Paying Bills They Don’t Owe