What is the bank impersonation scam?

The bank impersonation scam is a long-running fraud where scammers pretend to be representatives from a real bank or credit union. Victims are contacted by phone calls, text messages, emails, or fake mobile alerts claiming there is a problem with their account. The goal is to create urgency and convince the recipient to share sensitive information, approve transactions, or move money under the belief they are securing their account.

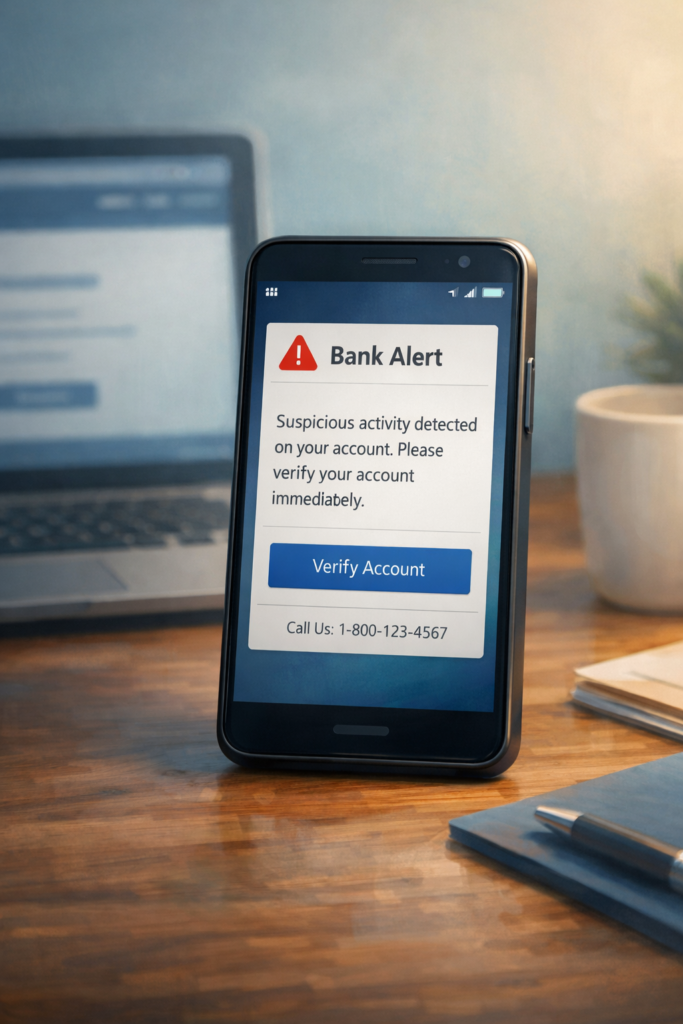

How this scam usually appears

This scam often begins with a message that appears to come directly from a bank, sometimes using the bank’s name, logo, or a spoofed phone number that looks legitimate. The message may warn of suspicious activity, a locked account, or a declined transaction. Victims are instructed to click a link, call a number, or reply immediately to verify their information. In phone-based versions, the scammer may already know partial details, making the contact feel authentic.

Why this scam continues to work

Bank impersonation scams succeed because they exploit trust in familiar institutions and fear of financial loss. Most people are conditioned to respond quickly when they believe their money is at risk. Because real banks do send fraud alerts, it can be difficult to tell the difference between legitimate security messages and fraudulent ones, especially when pressure and urgency are involved.

ScamProtector Pattern – Urgency and trust

Scammers often pressure victims to act immediately, discourage them from contacting their bank through official channels, and request one-time authentication codes or account verification. Real banks will never ask you to share security codes, passwords, or move money to protect your account.

Warning signs to watch for

Common warning signs include urgent language demanding immediate action, requests for one-time authentication codes, PINs, or full account numbers, and instructions to move money to “secure” or “temporary” accounts. Messages may contain links that closely resemble a bank’s website but have slight spelling differences. Phone callers may insist you stay on the line and discourage you from contacting your bank directly.

How to protect yourself

If you receive a message claiming to be from your bank, do not click links or use phone numbers provided in the message. Instead, contact your bank directly using the phone number on the back of your debit or credit card or by logging into your official banking app. Never share one-time authentication codes with anyone. For additional guidance, see How To Secure Your Online Accounts and How To Spot Fake Login Pages and Phishing Websites.

What to do If you’ve been targeted

If you believe you have interacted with a bank impersonation scam, contact your bank immediately using official contact information. Change your online banking passwords and monitor your accounts closely for unauthorized activity. If money was sent or sensitive information was shared, your bank may be able to take steps to limit further damage. A step-by-step response guide is available in I Got Scammed – Now What? A Clear Guide To Your Next Steps.

Why this scam is so common

Bank impersonation scams remain widespread because they are easy to scale and consistently effective. Automated calls, mass texts, and phishing emails allow scammers to reach thousands of people at once. Since financial institutions are trusted and people are naturally motivated to protect their money, this scam continues to resurface in slightly different forms over time.